How to Pay Sales Tax on Car in Nebraska: Simple Steps

Buying a car is a big deal. It is exciting. You love the new smell. You love the shiny paint. You love the way it drives. It feels great.

But then, the fun stops. You have to deal with paperwork. You have to deal with the state. You have to pay taxes.

This part is not fun. It is confusing. It can be scary.

I know how you feel. I have lived in Nebraska for years. I have bought old trucks. I have bought new sedans. Each time, I felt a little lost.

One time, I made a big mistake. I went to the wrong office. I waited in line for an hour. Then, they told me to leave. I was so mad. I was late for work. I want to save you from that day.

You do not need to be scared. You do not need to be a tax expert. You just need a friend to help. I will be that friend.

This guide is for you. It is simple. It is clear. It will show you how to pay sales tax on car in Nebraska.

We will take it step by step. We will look at the forms. We will look at the costs. We will get you back on the road.

Let’s get started.

The Big Nebraska Confusion: DMV vs. County Treasurer

First, we must clear up a myth. This is where I messed up.

Most people say, “I am going to the DMV to pay my taxes.”

In Nebraska, this is often wrong.

The Department of Motor Vehicles (DMV) handles your license. They test your driving. They check your eyes.

But they do not take your tax money.

In Nebraska, you pay taxes at the County Treasurer. This is a different office. Sometimes, they are in the same building. But often, they are not.

My Personal Experience

I remember buying my first used Honda. I was so proud. I drove to the DMV on O Street in Lincoln. I had my papers. I stood in a long line. The room was hot. Kids were crying.

Finally, I got to the front. The lady looked at my papers. She sighed.

“Honey,” she said. “We do not do that here. You need the Treasurer. They are downtown.”

My heart sank. I had wasted my lunch break. I had to drive across town. I was stressed.

Do not be like me. Know where to go.

You need the Nebraska county treasurer office car registration department. This is where the magic happens. This is where you pay.

So, check Google Maps. Find your “County Treasurer.” Go there. Do not go to the driver’s license station.

Credit: www.youtube.com

Understanding the Nebraska Sales Tax Rate

Now, let’s talk money. How much will this cost?

You need to know the rate. It changes based on where you live.

Nebraska has a state tax. There is also a local tax.

The Base Rate

The state of Nebraska takes 5.5%. This is the law for everyone.

If you buy a car for $10,000, the state wants $550.

The Local Twist

But wait. There is more. Cities have taxes too. Counties have taxes too.

Omaha has a tax. Lincoln has a tax. Small towns have taxes.

This is the Nebraska vehicle sales tax rate. It adds up.

For example, in some places, the total tax is 7.25%. In others, it is 5.5%.

It depends on your home address. It does not matter where you bought the car. It matters where you park the car.

If you buy a car in a cheap town but live in a city, you pay the city rate. You cannot trick the system.

Check the Nebraska Department of Revenue site. They have a map. It shows the rate for your house.

Buying from a Dealership vs. Private Seller

How you buy the car changes things. It changes how you pay.

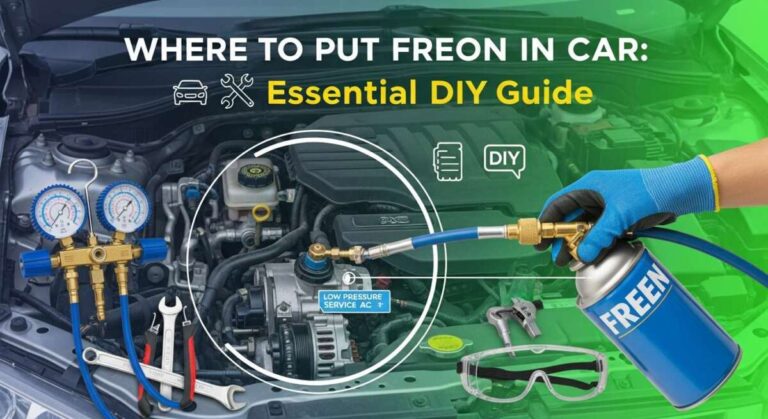

The Dealership Route

Dealers make it easy. They do the work for you.

When you buy from a big lot, look at the paper. Look at the invoice.

Usually, they collect the tax there. They take the money. They send it to the state.

They give you a paper. It shows you paid. You take that paper to the Treasurer. You pay for plates. You are done.

This is the “Easy Button.”

The Private Seller Route

This is harder. This is when you buy from a neighbor. Or a guy on Facebook.

He does not take tax. He just wants cash for the car.

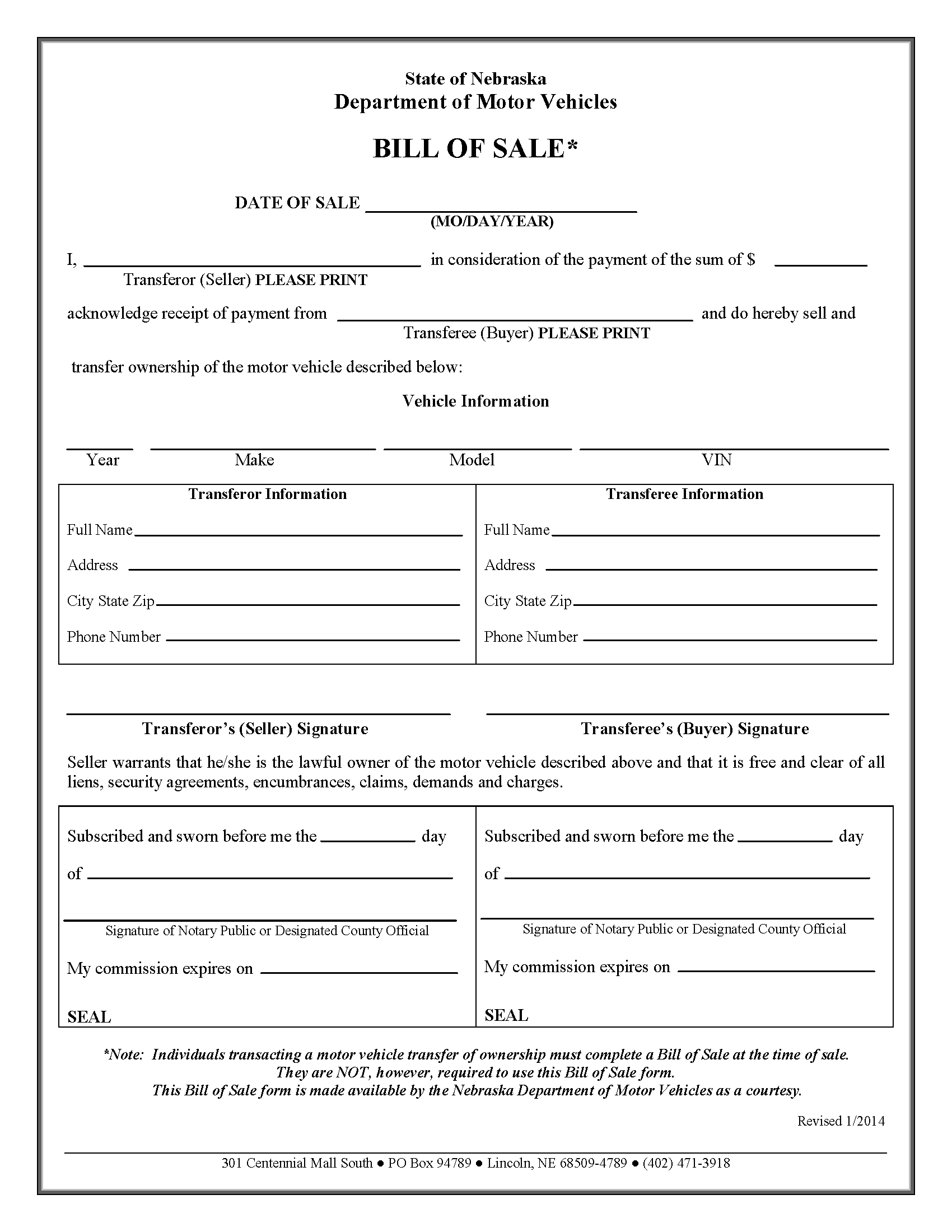

He gives you a title. He gives you a bill of sale.

Now, it is your job. You must save the money. You must go to the Treasurer. You pay the tax there.

If you spent all your cash on the car, you are in trouble. You need extra cash for the tax.

Plan ahead. Do not forget this cost.

Credit: legaltemplates.net

The Magic Document: Form 6 Explained

You will hear about “Form 6.” This is a very important paper.

Its full name is the Nebraska Sales/Use Tax and Tire Fee Statement. That is a long name. We just call it Form 6 Nebraska.

What is Form 6?

It is a receipt. It tells the state how much you paid. It tells them how much tax you owe.

Who Fills It Out?

If you go to a dealer, they fill it out. You just sign it.

If you buy from a private person, the County Treasurer fills it out. You do this when you register the car.

You need to tell the truth on this form.

Sometimes, people lie. They say they paid $500 for a nice car. They want to pay less tax.

Do not do this. The state checks. They know what cars are worth. If the price is too low, they ask questions. They audit you.

It is not worth the risk. Be honest. Pay the tax. Sleep well at night.

Calculating Your Total Cost

Let’s do some math. Don’t worry. It is simple math.

You want to know the total price. You can use a Nebraska car sales tax calculator online. Or you can use your phone.

The Formula

Here is how you do it:

- Write down the Car Price.

- Subtract your Trade-In value (we will talk about this soon).

- This is your “Taxable Amount.”

- Multiply by your Tax Rate (like 0.0725).

- This is your Tax.

Example Time

Let’s say you live in Lincoln. The tax is about 7.25%.

You buy a car for $20,000.

You have no trade-in.

$20,000 x 0.0725 = $1,450.

You owe $1,450.

Don’t Forget Fees

Tax is not the only cost.

- You pay for the Title ($10).

- You pay for the Tire Fee ($1 per tire).

- You pay for Plates (Registration).

- You might pay a Wheel Tax (in Omaha or Lincoln).

Bring extra money. It is better to have too much than too little.

Step-by-Step: How to Pay Sales Tax on Car in Nebraska

Okay. You are ready. Let’s go through the steps. Follow this list. You will be fine.

Step 1: Gather Your Documents

Do this at home. Put everything in a folder. Do not lose anything.

Step 2: The Inspection (If Needed)

Did you buy the car in Iowa? Or Kansas?

Does the car have a title from another state?

If yes, you need an inspection.

You must go to the Sheriff’s office. Or a specific inspection station.

They check the VIN number. They make sure the car is not stolen.

They give you a paper. Keep this paper.

If the car has a Nebraska title, skip this step.

Step 3: Visit the Treasurer

Go to the County Treasurer office. Go early in the morning. The lines are shorter.

Take a number. Sit down. Wait for your turn.

Step 4: The Payment

When they call your name, smile. Hand them your folder.

They will type on the computer. They will ask, “How do you want to pay?”

Hand them the money.

They will give you new plates. They will give you registration.

You are done!

Essential Documents Checklist

What goes in the folder? Here is the list.

- The Title: The seller must sign it. You must sign it. It is the most important paper.

- Bill of Sale: This proves the price. It has the date. It has the names.

- Proof of Insurance: You need a card. It must show your name. It must show the new car. You cannot register without it.

- Inspection Form: Only if the car is from out of state.

- Lease Agreement: If you are leasing.

- Your ID: Bring your driver’s license.

Check this list twice. Do not leave home without it.

Moving to Nebraska? What You Need to Know

Welcome to the Good Life! Nebraska is a great place. But you must switch your plates.

You have 30 days. You must register car in Nebraska quickly.

Did You Already Pay Tax?

This is a common question. “I paid tax in Texas. Do I pay again?”

Maybe.

Nebraska gives you credit.

If you paid 6% in Texas, and Nebraska is 5.5%, you pay zero.

If you paid 3% in another state, and Nebraska is 5.5%, you pay the difference. You pay 2.5%.

You must prove it. Show your old receipt. Show you paid tax before. If you cannot prove it, they charge you again. Keep your old papers!

The Trade-In Advantage

This is a secret weapon. It saves you money.

Nebraska taxes the difference.

How It Works

Imagine you buy a new car for $30,000.

That is a lot of tax.

But, you trade in your old car. The dealer gives you $10,000 for it.

The math changes.

$30,000 (New) – $10,000 (Old) = $20,000.

You only pay tax on $20,000.

This saves you hundreds of dollars.

Private Sale Warning

This only works at a dealer.

If you sell your car to Bob on Craigslist, you get cash.

Then you go buy a car from a dealer.

You pay full tax.

The state does not link the two sales.

To get the tax break, it must be one transaction. You must trade it in at the same time.

Think about this. Sometimes, getting less money for a trade-in is okay. Because you save on tax. Do the math.

Credit: esign.com

Frequently Asked Questions

Common Mistakes to Avoid

I have seen people make errors. These errors cost time. They cost money. Let’s avoid them.

Missing the Deadline

You have 30 days. The clock starts the day you buy the car.

If you wait 31 days, you pay a fee.

If you wait longer, the fee grows.

Do not wait. Go as soon as you can.

Wrong Insurance

Your insurance card must be current.

Some people bring an old card. It expired last month.

The Treasurer will say no. You have to leave. You have to call your agent. It is a hassle.

Check the date on your card.

Signing the Title Wrong

The title is a legal paper. Do not scratch out names. Do not use White-Out.

If you make a mistake, the title is void. You need a new one. This takes weeks.

Read carefully. Sign slowly. Use a blue or black pen.

Payment Methods and Fees

How do you pay?

Most offices take:

- Cash (Good).

- Checks (Good).

- Credit Cards (Okay).

The Credit Card Fee

If you use a card, there is a fee. Usually, it is 2% or 3%.

On a $1,000 tax bill, that is $30 extra.

That is a nice dinner. Why give it to the bank?

Bring a check. Or bring cash. It is cheaper.

Special Situations and Exemptions

Sometimes, you do not pay tax.

Family Gifts

Did your dad give you a car? That is nice!

You do not pay sales tax on a gift.

But, you need proof.

You need a form. It is the Vehicle title transfer Nebraska gift form.

Both of you sign it. It says, “No money changed hands.”

If you pay Dad $1, you pay tax on $1. But be honest. If it is a gift, it is a gift.

Non-Profits

Churches and schools do not pay tax. They have a special number. They show this number at the office.

Disabled Tax Exemptions

Some disabled veterans get a break.

They may not pay tax on one car.

Or they pay less for plates.

Ask the Treasurer. Bring your VA papers. See if you qualify.

A Guide to Major Nebraska Counties

Every county is a little different. Here are the big ones.

Douglas County (Omaha)

They have many offices. The lines can be long.

They have a “Wheel Tax.” This is extra money for roads. It is about $60.

You can check wait times online. This is very helpful.

Lancaster County (Lincoln)

The main office is on 46th Street.

They also have a Wheel Tax.

They are very strict about insurance. Have a paper copy.

Sarpy County (Papillion/Bellevue)

They have a nice office near the courthouse.

They are growing fast.

Check their website for hours.

If you live in a rural county, it is easier. The Treasurer might know your name. It is usually faster. But the rules are the same.

Why Accuracy Matters

You might think, “I can guess the price.”

Do not guess.

The state audits sales.

If they think you cheated, they send a bill. They add penalties.

It is not worth it.

Paying the right amount keeps you safe. It keeps your record clean.

Prepare for the Wheel Tax

I mentioned this before. But it shocks people.

“Why is my bill so high?”

If you live in a city, you pay for city streets.

This is the Wheel Tax.

It is not sales tax. It is a registration fee.

But you pay it at the same time.

It adds $50 to $80 to your bill.

Know this is coming. Do not be surprised.

Digital Tools Can Help

The Nebraska DMV website is good.

They have a tool to estimate taxes.

Use it.

Type in the price. Type in the year.

It tells you a number.

Write it down. Bring that much money.

Being prepared feels good. It stops the anxiety.

Conclusion

We have covered a lot.

We talked about the offices. We talked about the rates. We talked about the forms.

Paying sales tax on a car in Nebraska is a chore. Nobody likes it.

But now, you know how to do it.

You know not to go to the DMV. You know to go to the Treasurer.

You know to bring your title and bill of sale.

You know to check your insurance.

Think of it this way. That tax pays for the roads. It pays for the bridges. It helps you drive your new car safely.

Take a deep breath. Gather your papers. Go to the office.

You can do this.

Once you pay, you get your shiny new plates.

You put them on your car.

And then? You drive. You enjoy the ride.

You earned it.

Safe travels, my friend.

Frequently Asked Questions (FAQ)

1. How much is the sales tax on a car in Nebraska?

The base sales tax rate for vehicles in Nebraska is 5.5%. However, local city and county taxes often apply, which can raise the total rate to 7% or more. The exact amount depends on the address where you register the vehicle.

2. Where do I pay my car sales tax in Nebraska?

You must pay your car sales tax at your local County Treasurer’s office, not the DMV. While the DMV handles driver’s licenses, the County Treasurer handles vehicle titles, registrations, and tax collections.

3. Can I pay my Nebraska car sales tax online?

Typically, no. For a newly purchased vehicle, you usually need to visit the County Treasurer in person to present your title and proof of insurance. However, lease buyouts or annual registration renewals can sometimes be done online depending on the county.

4. What forms do I need to pay car sales tax?

The primary form is the Nebraska Sales/Use Tax and Tire Fee Statement, also known as Form 6. You will also need the vehicle title, a bill of sale, and valid proof of insurance to complete the transaction.

5. Is there a penalty for paying car sales tax late?

Yes, you have 30 days from the date of purchase to pay your sales tax and register the vehicle. If you miss this deadline, you will be charged a penalty fee, and you cannot legally drive the car on public roads.

6. Do I pay sales tax if I buy a car from a private seller?

Yes, you still have to pay sales tax on a private party purchase. The seller does not collect the tax. Instead, you pay the full tax amount directly to the County Treasurer when you go to register the vehicle and transfer the title.

7. Does a trade-in reduce my sales tax in Nebraska?

Yes, it does. In Nebraska, you only pay sales tax on the difference between the purchase price of the new car and the value of your trade-in vehicle. This can save you a significant amount of money.

8. Do I pay tax if I receive a car as a gift?

Generally, no. If a family member gifts you a car, you may be exempt from sales tax. You will need to complete a specific exemption form (often Form 6MB) stating that no money was exchanged for the vehicle.